Placer.ai Alternative in Philadelphia | StreetSpring

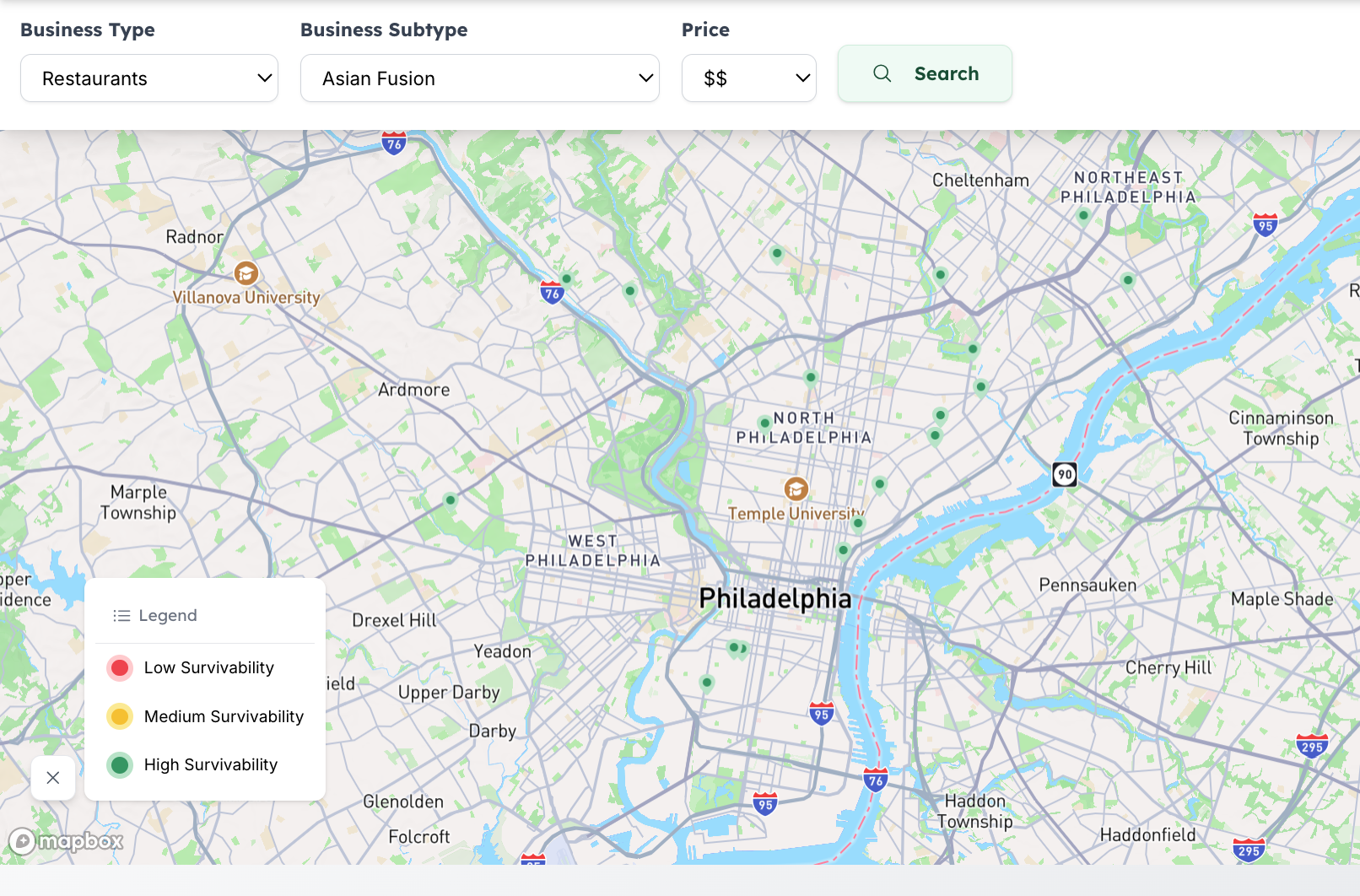

Compare StreetSpring vs Placer.ai: Predict success, not just foot traffic. StreetSpring’s AI-powered location intelligence software forecasts business survivability across Philadelphia using 87+ data factors.

Placer.ai Alternative in Philadelphia

If you’re searching for a Placer.ai alternative in Philadelphia, StreetSpring delivers more than foot traffic metrics—it predicts success before you open.

While Placer.ai measures visits to existing businesses, StreetSpring’s AI-driven location intelligence software identifies where a new business will thrive—even before launch.

This article compares StreetSpring vs Placer.ai in terms of data depth, predictive analytics, and usability for agents, brokers, and business owners. Discover how StreetSpring simplifies predictive retail analytics into one actionable metric—the Survivability Score—giving professionals a data-driven edge to choose high-performing Philadelphia locations for long-term growth and profitability.

StreetSpring vs. Placer.ai: Predict Success, Not Just Foot Traffic

In commercial real estate, knowing where people go is valuable—but predicting where businesses will succeed is revolutionary.

Placer.ai built its name tracking foot traffic analytics, but when it comes to forecasting future performance, StreetSpring is the superior choice.

If you’re comparing the two, StreetSpring combines predictive modeling, consumer expenditure data, and competition insights to forecast which locations will perform best—before a business opens its doors. It turns raw retail data into predictive power that directly drives profitability.

The Core Difference: Foot Traffic vs. Predictive Success

Placer.ai tells you where people have been, using mobile GPS data to estimate visits. That helps for existing stores, but it doesn’t show whether a new concept will succeed.

StreetSpring, however, answers that missing question.

Predictive Retail Analytics vs. Observational Data

Using AI site selection modeling, StreetSpring determines not just who passes by—but who spends, what they spend on, and how a business fits the market.

For brokers and real estate professionals, this means decisions based on profitability potential, not just footfall volume.

For location survivability frameworks, see Business Location Analysis & Survivability (Philadelphia).

Why StreetSpring Is Built for Philadelphia’s Market

Philadelphia’s neighborhoods operate like micro-economies—Fishtown’s nightlife is nothing like Chestnut Hill’s boutique shoppers.

Localized Market Intelligence

National tools like Placer.ai generalize data, while StreetSpring’s predictive retail analytics model is trained exclusively on local datasets, including:

- Census block demographics (income, age, education)

- Consumer Expenditure (CEX) on specific business types

- Competitor ranking by longevity and customer ratings

- Rent-per-square-foot and historical survivability trends

The result is a location-specific Survivability Score, predicting which business categories will succeed in which Philadelphia neighborhoods.

Learn how this AI integrates across tools in Philadelphia Site Selection Software (AI Location Intelligence).

Why Real Estate Agents Prefer StreetSpring

For years, tenant reps and agents guided clients using instinct and demographic reports.

Placer.ai gave them traffic counts—StreetSpring gives them success probabilities.

Advantages for Real Estate Professionals

- Present data-backed recommendations with confidence

- Quantify ROI with a single Survivability Score

- Identify under-the-radar profitable sites

- Build stronger trust with landlords and investors

StreetSpring turns every tour into a data-driven advisory session, redefining what client service looks like.

Explore related use cases in AI Tools for Tenant Reps in Philadelphia.

What Placer.ai Does Well—and Where It Stops Short

Placer.ai excels at visualizing existing store performance—you can assess foot traffic, competitor overlap, and regional activity.

However, its predictive capability ends there.

The Limitation of Historical Models

Placer.ai depends entirely on past performance—making it unsuitable for new businesses or concepts without sales history.

StreetSpring, conversely, models future performance, not past patterns. Its proprietary algorithm predicts outcomes based on environment, demographics, and spending trends—no prior data needed.

For technical insights, see Survivability Score: How We Calculate It & Why It Matters.

Predictive Modeling: StreetSpring’s True Advantage

StreetSpring’s AI model analyzes 87 weighted variables to predict business success over time.

Core Predictive Factors

- Local consumer spending by category

- Competitor count and quality

- Rent-to-revenue efficiency

- Mobility and walkability trends

- Neighborhood income and growth rate

Example:

A café in Old City may score 92% survivability, while one in Midtown scores 68% due to high rent and dense competition.

That’s the level of predictive clarity where Placer.ai’s data ends—and StreetSpring’s begins.

For consumer spending data, see Consumer Expenditure (CEX) & Growth Analysis.

StreetSpring vs. Placer.ai: Feature Comparison

| Feature | Placer.ai | StreetSpring |

|---|---|---|

| Primary Use | Analyze existing store performance | Predict success of new or existing businesses |

| Market Focus | Nationwide | Philadelphia-specific (localized data) |

| Key Metric | Foot traffic volume | Survivability Score (87+ factors) |

| Data Sources | Mobile GPS data | Spending, rent, mobility, competition, CEX |

| Ideal Users | Established chains & investors | Agents, landlords, and entrepreneurs |

| Predictive Power | Limited to past trends | Full predictive modeling for new concepts |

| Pricing | Enterprise-only | Affordable monthly plans |

StreetSpring democratizes predictive intelligence—accessible, local, and actionable.

A Case Example: The Boutique Decision

A Philadelphia retail broker compared two boutique sites—Rittenhouse vs. Fishtown.

Placer.ai showed similar foot traffic volumes.

StreetSpring revealed deeper truth: Fishtown had 22% higher spending, lower rent, and fewer direct competitors—earning a 90% Survivability Score vs. Rittenhouse’s 71%.

The client chose Fishtown and exceeded year-one revenue projections by 18%.

That’s predictive precision in action.

Why Predictive Data Matters More Than Ever

Post-pandemic, Philadelphia’s retail ecosystem is shifting constantly.

Foot traffic data tells you what happened yesterday.

StreetSpring’s predictive AI tells you what will happen next.

Predictive Benefits

- Identify tenant categories with longevity

- Justify every leasing recommendation

- Quantify investor risk before commitment

StreetSpring’s AI location forecasting helps future-proof portfolios.

For instant address-level testing, visit Add a Location: Analyze Any Address Instantly.

FAQs: StreetSpring vs. Placer.ai

Q1: Can StreetSpring replace Placer.ai completely?

For new or local businesses in Philadelphia—yes. It offers predictive analytics that Placer.ai doesn’t provide.

Q2: Does StreetSpring track foot traffic too?

Yes, but it combines that with spending, rent, and competition metrics for full profitability modeling.

Q3: Who benefits most from StreetSpring?

Tenant reps, landlords, and entrepreneurs seeking high-survivability sites and reduced vacancy risk.

Q4: Can I analyze multiple concepts at once?

Yes—compare business types (e.g., cafés vs gyms) for address-specific performance.

Q5: How often is the data updated?

Continuously, using refreshed mobility, expenditure, and rental datasets.

The Takeaway: StreetSpring Predicts What Comes Next

Placer.ai shows the past. StreetSpring predicts the future.

For anyone seeking a Placer.ai alternative in Philadelphia, StreetSpring offers local accuracy, predictive modeling, and simplicity—empowering agents, landlords, and investors alike.

Instead of tracking footfall, it forecasts business survivability, helping professionals select winning locations before leases are signed.