Consumer Expenditure (CEX) & Growth Analysis (Philadelphia)

StreetSpring’s CEX & Growth Analysis reveals how—and where—Philadelphians spend by business type, then forecasts growth to predict the best locations for new businesses.

Consumer Expenditure (CEX) & Growth Analysis: The Spending Signal Behind Business Success

If you’re searching for reliable consumer expenditure data in Philadelphia, StreetSpring goes far beyond demographics. Our CEX (Consumer Expenditure) & Growth Analysis measures how much locals spend on specific business types—restaurants, gyms, salons, cafés—and whether that spending is rising or falling. Unlike tools that only estimate demand, StreetSpring predicts where spending will increase and which businesses can capture it.

This guide explains how block-level spending, forecast growth, and market‑share modeling turn complex data into actionable predictions for entrepreneurs, agents, and landlords.

What Is Consumer Expenditure (CEX)?

CEX measures how much people in a given area spend across categories. It’s a core input powering StreetSpring’s Survivability Score.

- Block-level precision for Philadelphia (not coarse, national averages)

- By business type, not just broad retail (e.g., coffee shops vs. Italian restaurants)

- Change over time, revealing which sub‑categories are actually growing

This lets agents and founders pinpoint not just good neighborhoods—but the best‑fit addresses for each concept.

See how it plugs into the platform: Philadelphia Site Selection Software (AI Location Intelligence).

Why StreetSpring’s CEX Is Different

Most platforms lump spend into generic buckets. StreetSpring models the nuance that drives profitability with integrated data layers:

- Observed consumer spending behavior (not just estimates)

- Business‑type projections (Italian vs. sandwich shops, cafés vs. juice bars)

- Market‑share forecasting (share of spend a new site can capture)

- Neighborhood growth tracking (rising vs. declining categories)

Connects directly to: Survivability Score: How We Calculate It & Why It Matters.

Why Growth Trends Matter

Raw spend isn’t enough—the direction of spend drives long‑term success. StreetSpring tracks category‑level growth rates across Philadelphia.

- Spot rising markets before they peak

- Avoid corridors where demand is flattening

- Tune lease strategy to momentum, not averages

Example: Café spend +8% YoY in Fishtown vs. fitness spend –4% in Old City leads to very different risk profiles and negotiation tactics.

See how growth complements traffic data in Placer.ai Alternative in Philadelphia.

What Other Tools Miss

Trade‑area and traffic tools (national competitors) emphasize demographics and visits, but often miss projected spending shifts. Foot traffic ≠ sales.

StreetSpring merges CEX + market‑share forecasting to reveal true revenue potential.

2025 user survey highlights:

- 88% of Philly SMBs wanted their agent to use StreetSpring before leasing.

- 67% said CEX insights improved rent negotiations.

For head‑to‑head breakdowns, see StreetSpring vs Competitors.

Balancing CEX with Rent: The Profitability Equation

A high‑spend area isn’t always profitable if rent overwhelms potential revenue. StreetSpring integrates rent per sq ft with CEX potential to surface profit‑to‑rent ratios.

Example: A corridor with $6M annual spend looks appealing, but 20% above‑market rent can sink survivability. Meanwhile, a mid‑tier zone with lower rent + steady growth yields higher ROI.

Landlord strategies: How Landlord Representatives in Philadelphia Can Reduce Vacancy & Increase Tenant Longevity.

Real Example: Projecting Growth for a Juice Bar

- Northern Liberties: $18 per‑capita monthly spend, +12% annual growth

- Center City: $22 per‑capita, flat growth

Despite higher current spend, Center City is saturated. Northern Liberties’ higher growth + lower competition yields a better survivability outlook.

Integrating CEX into Survivability Predictions

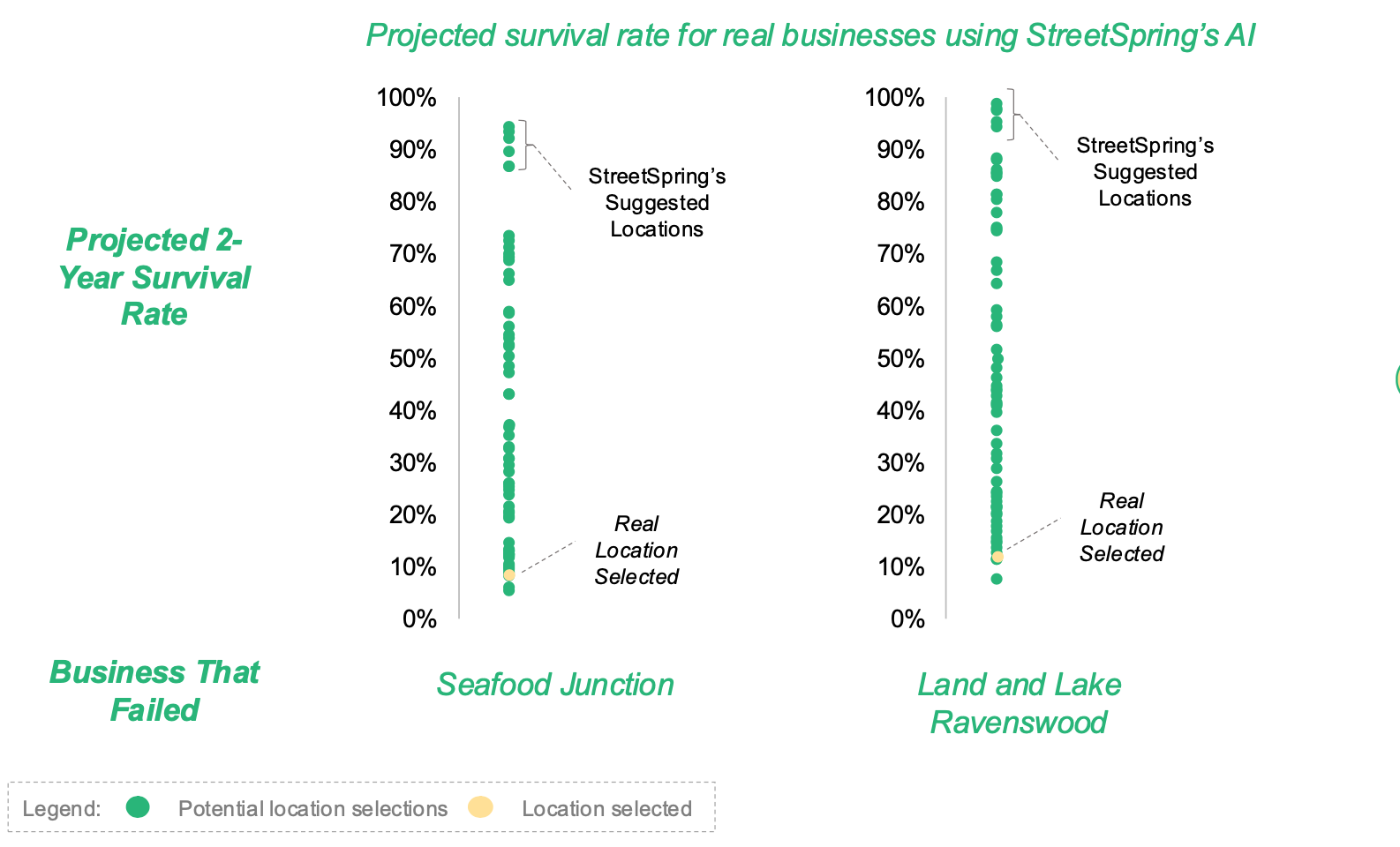

CEX is one of 87 model factors. Combined with rent, competition, walkability, and mobility, it determines sustainable profitability, not just launch potential.

- Declining spend → model flags risk

- Accelerating growth → Survivability Score rises, especially with low competition

Tenant‑rep workflow: AI Tools for Tenant Reps in Philadelphia.

For Agents and Landlords: Turning Data into Decisions

Tenant Reps: Justify site picks with spend + growth + share proofs.

Landlords: Identify tenant categories most likely to thrive at each asset.

CEX turns instinct into evidence‑based strategy, reducing vacancy and increasing tenant longevity.

For the bigger picture, see StreetSpring vs Competitors.

FAQs

Q1: What does CEX show that demographics don’t?

Demographics reveal who lives there; CEX shows how and where they spend.

Q2: Does it project future growth or only current spend?

Both—StreetSpring forecasts 12–24 months ahead to anticipate shifts.

Q3: How can agents use CEX?

Export reports that combine spend, rent, and competition to strengthen recommendations.

Q4: Is CEX relevant beyond retail?

Yes—applies to fitness, restaurants, healthcare, salons, and most brick‑and‑mortar models.

The Takeaway

In Philadelphia’s fast‑moving market, consumer expenditure is a leading indicator of business success. But data alone isn’t enough—you need prediction.

StreetSpring turns CEX into clear, forward‑looking models that reveal where spending—and opportunity—is headed next. Whether you’re an entrepreneur selecting a first site, a broker advising clients, or a landlord optimizing ROI, StreetSpring converts complex retail analytics into confident, profitable decisions.