Mapzot Alternative in Philadelphia | StreetSpring

Compare StreetSpring vs Mapzot for AI-driven site selection. Discover how StreetSpring predicts business survivability across Philadelphia using 87+ data factors for real-time, hyper-local insights.

Mapzot Alternative in Philadelphia

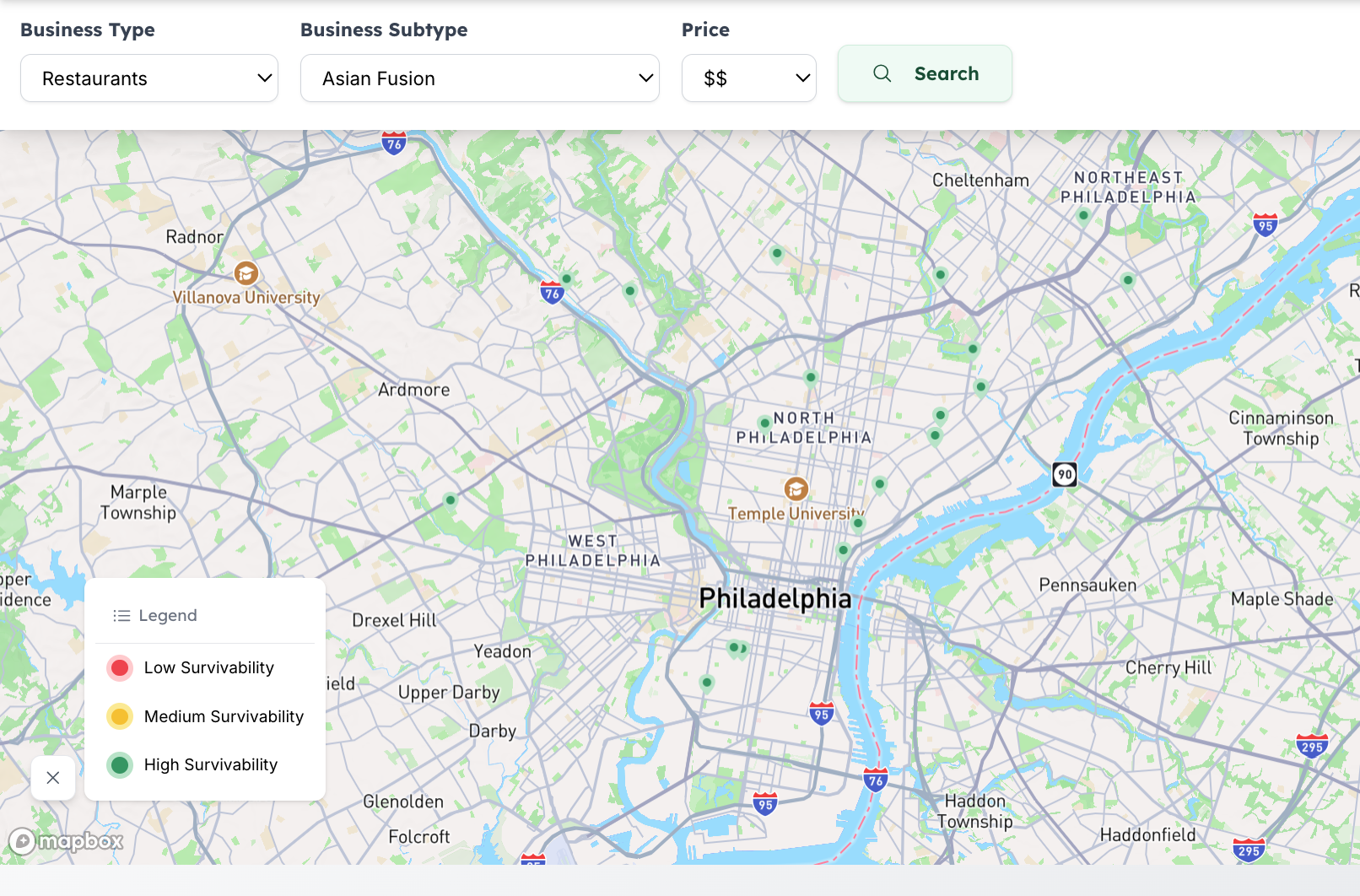

Looking for a Mapzot alternative in Philadelphia that goes beyond heatmaps and trade area modeling?

StreetSpring delivers predictive precision for where new businesses will thrive, not just where foot traffic exists.

While Mapzot helps visualize consumer clusters, StreetSpring’s AI model predicts the likelihood of success for a specific business in a specific location, offering a true competitive advantage for real estate agents, landlords, and entrepreneurs across the Philadelphia metro area.

StreetSpring vs. Mapzot: Local Precision Meets Predictive Power

| Feature | StreetSpring | Mapzot |

|---|---|---|

| Market Focus | Philadelphia (hyper-local) | Nationwide |

| Primary Metric | Survivability Score (predicts success) | Trade area & demographic mapping |

| Data Inputs | 87+ localized factors | National demographic data |

| User Base | Agents, landlords, entrepreneurs | National brands, planners |

| Output Type | Actionable predictions | Visualized consumer heatmaps |

| Accuracy (Philadelphia) | 95% predictive accuracy | 70–80% regional-level accuracy |

StreetSpring was built specifically for Philadelphia’s urban landscape, incorporating local datasets unavailable in Mapzot’s national platform.

Learn about StreetSpring’s modeling foundation in Business Location Analysis & Survivability (Philadelphia).

The Difference: Prediction vs. Visualization

Mapzot visualizes retail and demographic clusters, but it can’t tell you which address is most likely to succeed.

StreetSpring bridges that gap.

What StreetSpring Adds

- Predicts whether a new location will survive or fail

- Quantifies rent sustainability vs. expected revenue

- Analyzes competition quality, not just proximity

- Measures consumer expenditure (CEX) trends over time

StreetSpring transforms static data into predictive insights—ideal for tenant reps and landlords making time-sensitive decisions.

For tenant-side tools, see AI Tools for Tenant Reps in Philadelphia.

Built for Philadelphia’s Neighborhood Diversity

From Fishtown to University City, retail dynamics change block by block.

StreetSpring’s hyper-local AI analyzes real-world outcomes from thousands of Philadelphia businesses to identify patterns that lead to long-term success.

Key factors include:

- Rent per sq ft vs. consumer demand

- Competitor density & longevity

- Walkability, transit, and foot traffic trends

- Demographics and income stability

Explore related insights in Philadelphia Site Selection Software (AI Location Intelligence).

Why StreetSpring Replaces Mapzot for Agents and Landlords

For Agents

StreetSpring predicts which listings will perform best for each business type, helping agents build credibility and close deals faster.

For Landlords

StreetSpring forecasts tenant longevity, helping reduce vacancy rates by identifying stable tenant categories.

For Entrepreneurs

StreetSpring reveals hidden opportunities—locations that offer profitability but remain underpriced or overlooked.

For landlord-focused strategies, see How Landlord Representatives in Philadelphia Can Reduce Vacancy & Increase Tenant Longevity.

Case Study: Salon Site Selection Example

A broker compared two potential salon spaces:

- Rittenhouse Square – High rent, premium competition, 74% survivability.

- Northern Liberties – Moderate rent, growing demand, 91% survivability.

StreetSpring’s analysis revealed Northern Liberties was 23% more likely to sustain profitability long-term—information Mapzot’s demographic mapping alone could not provide.

The Survivability Score Advantage

StreetSpring’s Survivability Score provides a single, actionable number predicting how likely a business will survive in its first two years.

Core Model Inputs

- Rent and property costs

- Local consumer spending (CEX)

- Competitive presence and ratings

- Walk, bike, and transit scores

- Demographic momentum (growth vs. decline)

Learn more in Survivability Score: How We Calculate It & Why It Matters.

StreetSpring vs. Mapzot: Key Takeaways

| Category | StreetSpring | Mapzot |

|---|---|---|

| Prediction Model | Yes – AI-based survivability forecasting | No – Static demographic mapping |

| Data Resolution | Census block & property level | City or ZIP-level |

| Use Cases | Site selection, leasing, valuation | Trade area visualization |

| User Type | Agents, landlords, entrepreneurs | Corporate planners |

| Output | Probability-based success metrics | Heatmap visualization |

For instant address-level testing, visit Add a Location: Analyze Any Address Instantly.

Why StreetSpring Is the Clear Mapzot Alternative

Mapzot visualizes where people live and shop—StreetSpring predicts where businesses succeed.

It’s the next generation of AI-powered location intelligence, built for on-the-ground real estate professionals.

- Localized data accuracy (Philadelphia-specific)

- 87 predictive variables integrated into one score

- Transparent pricing and instant insights

- Designed for agents, landlords, and business owners

FAQs: StreetSpring vs Mapzot

Q1: How is StreetSpring different from Mapzot?

StreetSpring predicts success probability using AI; Mapzot only maps trade areas and demographics.

Q2: Does StreetSpring include foot traffic data?

Yes, but it’s combined with spending, rent, and competitive factors for predictive scoring.

Q3: Can I use StreetSpring for off-market analysis?

Absolutely—use the Add a Location feature to analyze any Philadelphia property.

Q4: Who benefits most from StreetSpring?

Tenant reps, landlords, and entrepreneurs making data-backed location decisions.

Q5: Is StreetSpring expanding beyond Philadelphia?

Yes—expansion is planned for New York, Chicago, and Los Angeles.